Oops. One of the tables below is a pain in the butt to read. If you care to peruse the biggest up and down days of the 25 years to 2009 here's the PDF the tables came from.

Original post:

There are quite a few arguments for the individual investor to remain fully invested but "Missing the Best Days" is not one of them.

Off the top of my head the most important reason is the fact that in the U.S. historical daily market returns are positive.

Another good reason not to time the market is the psychological difficulty of either buying back at a higher price an issue that has been previously sold or overcoming the endowment effect and selling something one is emotionally 'invested in'. If you can't do both you absolutely shouldn't be trading.

There are probably a dozen others but those two are pretty important.

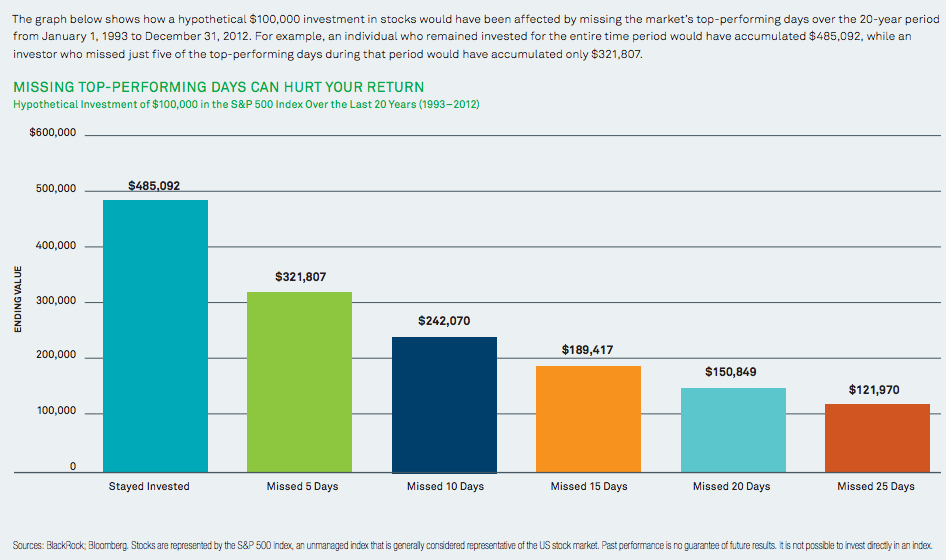

The reason for this meander? The Reformed Broker tips us to some BlackRock marketing material:

TRB begins his piece with one of the smartest sentences you'll find:

Optimism as a Default Setting is the only way to successfully fund a retirement over the long stretch.Then he goes and shows the BlackRock graph.

Shoot

Anyone running money during the fall of 2008 had a lesson hammered into their skulls: "The 'Best Days' tend to happen during bear markets. And vice versa, if you prefer your vice, versa, for the worst days.

Here's a list of the best and worst days for the 25 years through 2009 from By Daniel A. Hughes, CFP ® , ChFC:

| Fallacy of Missing the Best Days in the Market 001 pdf |

So Josh is right, stay invested.

Another odd little factoid is that rather than cherry picking the best days argument if you eliminate both the best days and the worst days you end up a bit over 1% better than buy-and-hold. Who knew?

Or as Fama/French put it:

Is semi-variance a more useful measure of downside risk than standard deviation? My clients aren't worried about market surges, they're worried about market crashes....

...Let's now examine whether you really believe what you say about your client's tastes. In our (academic) terms, your statements imply that your clients are risk neutral on the upside but risk averse on the downside. If this is the case, the semi-variance, which ignores upside risk, is probably a better single measure of risk than the variance, but the conclusion is subject to the caveats above about the skewness of return distributions for longer return horizons....That's me, risk neutral on the upside and risk averse on the downside.

Which of course reminds me of something, in this case a line one of the MER billion dollar book guys used to use: "Mr. Bigg, I have to ascertain your risk tolerance; wanna cut the cards for $5g's?"

Next week we'll go over the "S&P" index is superior to the DJIA argument.

(hint r=.92--.99 depending on the timeframe)

BlackRock are product pushers, see also:

BlackRock Says Volatility is an Asset Class (VIX; VXX)