The cup-and-handle is one of the most constructive chart patterns and since Bill O'Neill (founder, Investors' Business Daily) popularized the set-up, one of the rarest. The moves after the breakout can range from 25 to 1000% but as he advises, don't chase. If it pulls back a bit, great. If it falls below the breakout line: sell.

The stock is up another 96 cents right now, at $67.14. On Monday Goldman put it on their Conviction Buy List and the stock popped 7.3% to $63.61. Up another $2.46 yesterday.

More after the jump.

From Slope of Hope:

Elon’s Next Victory?

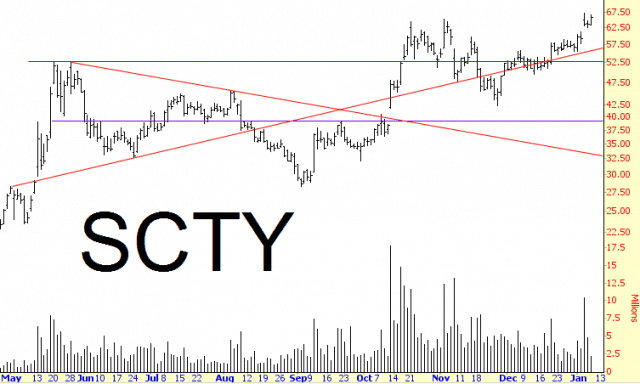

Elon Musk and one of his companies, Tesla, had a sensational 2013. TSLA peaked back on September 30th and has lost a lot of its star power since then, but a different Musk firm, SolarCity, might be ready to take its place as the new star. Just take a look not only at the very attractive pattern but, more importantly, the swelling volume. This is a stock that looks like it’s going places.

That cup-and-handle is a bit raggedy but still qualifies.

*The stock had gotten so whippy in October/November 2013 that we quit commenting on it.

On Oct. 11, 2013 we had started talking short with the stock at $46.69:

Stock in Elon Musk's Other Company is Up 22% Today (SCTY)

Important caveat:Ten day's later, Oct 21:

SCTY is not TSLA. It is shortable, although with 25% of the stock sold short there are a lot of folks on that side of the boat right now.

$46.69 up $8.36 (+21.82%) That price puts the company's market cap at about $3.5 billion with estimated revenues of $250mm next year....

With 3D Co. Arcam Up 13% Today and Solar City Up 37% in 4 days It Is Time To Hire a Kid

...Today's price $63.34. Four days ago (Oct. 15) it was still trading at $46.54. In four days.Seventeen day's after that, Nov. 7, 2013:

It must be even more shortable....

...I feel old.

At least we were on the right side of Arcam. The SCTY short is still crowded but will reward the nimble (barring a buyout which could really spoil your day)...

UPDATED--Even Though It's Down 17% SolarCity is Still Trading at 13 Times SALES (SCTY)

...At the recent $49.03 down 17.8% the company has a market cap of $4.05 Billion giving you a price to sales ratio of 13.5 with no earnings in the foreseeable future....A couple hours later that was supplanted by:

Nov. 7, 2013

Elon Musk Loses $1.5 Bil On Tesla, SolarCity (TSLA; SCTY)

It closed that day at $49.69 down $9.96 (16.7%) and except for a rather amazing factoid on Nov. 22 (The #1 and #2 Best Performing Stocks in the Russell 1000 Have the Same Chairman) that was the last time we mentioned it.

So yeah, we got caught caught flat footed by the action in this new year.

And we've been following it for a while:

"Coming Up: Elon Musk’s SolarCity Seeks IPO Multiple of 19 Times Peers Tomorrow (SCTY)"

"SolarCity postpones initial public offering, according to report" (SCTY)

More Elon Musk: "5 things to know about SolarCity’s IPO (and it’s not all good)"

Sorry.