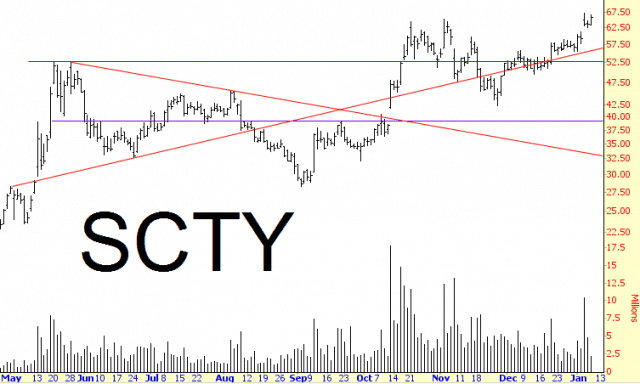

This is make or break time for the stock. Between the close on Friday Jan. 3 and the open on Monday Jan. 6 the stock gapped up from $59.27 to $65.10 before setting its all time high of $69.91 on the 9th.

We are now three bucks back into the gap. From our Jan. 9 post "Chartology: Elon Musk's SolarCity is Breaking Out of a Cup-and-Handle (SCTY)":

The cup-and-handle is one of the most constructive chart patterns and since Bill O'Neill (founder, Investors' Business Daily) popularized the set-up, one of the rarest. The moves after the breakout can range from 25 to 1000% but as he advises, don't chase. If it pulls back a bit, great. If it falls below the breakout line: sell....

The stock is up another 96 cents right now, at $67.14. On Monday Goldman put it on their Conviction Buy List and the stock popped 7.3% to $63.61. Up another $2.46 yesterday.

More after the jump.

Because of the success getting panels on roofs utilities are pushing for two things:

1) That customers with rooftop systems pay something for maintenance of the grid and;

2) That the payments they make when rooftop systems push electrons into the grid be based on the wholesale prices the utilities pay other suppliers.

Either one of which reduces the attraction of the Solar City business model.

From Greentech (Jan. 9):

The solar financier’s stock price isn’t the only thing breaking records this week.

SolarCity installed nearly a third of all U.S. residential PV in the third quarter of 2013, installing almost four times as much as its closest competitor, Vivint Solar, according to GTM Research's US PV Leaderboard, released today.

The leaders in Q3 residential solar installs in the United States:

With a newfound ability to raise public capital and a mandate to continue its rapid expansion, SolarCity remained aggressive throughout 2013. "In addition to a steadily growing market share, the company made a bevy of moves over the course of the year, ranging from the first securitized distributed solar deal to the acquisitions of Paramount Solar and Zep Solar," said Shayle Kann, Senior Vice President, GTM Research. "SolarCity's 2014 guidance suggests another rapid year of growth, barring bottlenecks in component costs, project finance or regulation."

- SolarCity

- Vivint

- Verengo

- REC Solar

- Real Goods Solar

SolarCity's diverse sales strategies have played a major role in the company's ability to capture such a large share of the residential market. Solar analyst Nicole Litvak cited its key partnerships with companies like Home Depot, Honda, and Viridian Energy to tap new sources of customers. "The installer has been quick to enter and dominate new residential growth markets such as New York and Connecticut," added Litvak....MORE