We are still in a bull market and markets being perverse we'll probably have a summer rally that drives the Sell in May folks insane. Their prayers for a correction to scale back in on go unanswered and in their madness to participate they put in the top.Just to make sure everyone understands, our linkee (and we) has been bullish in the face of some serious nervous nellyism on the part of the commentariat.

Or something....

This is a dangerous little game I am playing, the markets will reverse one of these days, but being full to the brim with hubris, I'm on-board with every other egomaniac who thinks they will be able to identify the turn when it comes.

From Dragonfly Capital:

The SPY Is NOT Extended and May NEVER Pull Back

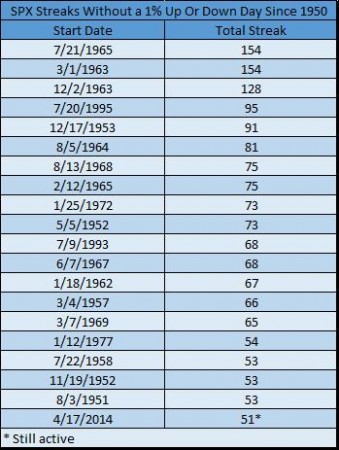

The idea that the SPDR S&P 500 ($SPY) is overbought is absurd if you look at it from anything longer than a day traders perspective. Extended? Let’s get serious. It may be boring to sit and watch the index go up constantly, but that does not make it overbought or extended. And it also does not make it likely to correct, just because it has not for a long time. My Friend Ryan Detrick at Schaeffer’s Investment points out in the chart below that the market does not often wait a long time between 1% moves.

But boatloads of data can be viewed many ways. The common view will be that the vast majority of the time a 1% move occurs in less than 50 days. So this streak is bound to end soon. But looking at how the probabilities for extremes can play out in actuality, there are 2 instances where the streak has gone 3X further than the current one. It may never pullback....MORE