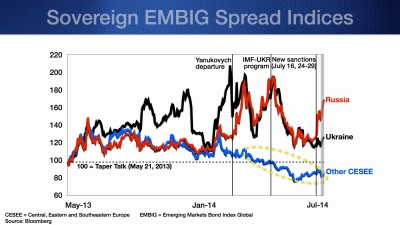

The conflict in Ukraine and the related imposition of sanctions against Russia signal an escalation of geopolitical tensions that is already being felt in the Russian financial markets (Chart 1). A deterioration in the conflict, with or even without a further escalation of sanctions and counter-sanctions, could have a substantial adverse impact on the Russian economy through direct and indirect (confidence) channels.

Chart 1

What would be the repercussions for the rest of Europe if there were to be disruptions in trade or financial flows with Russia, or if economic growth in Russia were to take a sharp downturn? To understand which countries in Europe might be most affected, we looked at the broad channels by which they are connected to Russia—their trade, energy, investment, and financial ties. See also separate blog on Russia-Caucasus and Central Asia links.

We find that Eastern European countries have the closest links with Russia and some of them could be seriously affected by a sharp slowdown of the Russian economy or a ratcheting up of sanctions and countersanctions. Western European countries are relatively less linked but some could also see significant effects. These conclusions, of course, are based broadly on the potential channels rather than a quantification of the potential impact, which anyway could be dominated by confidence effects from geopolitical tensions.

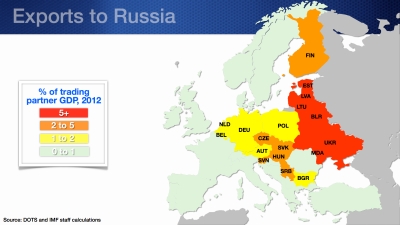

Trade links

For most European countries, Russia is not a major export market (Chart 2). Therefore, slower growth in Russia would probably not hurt them too much. However, for many of Russia’s immediate neighbors such as Belarus, Ukraine, Moldova, and the Baltics, whose exports to Russia exceed 5 percent of their respective GDP, the impact could be substantial.

Chart 2

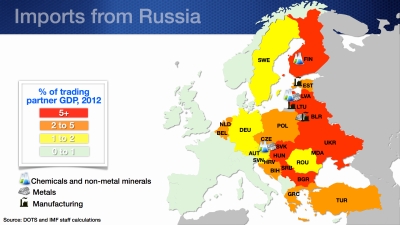

But European countries depend more on Russia on the import side—particularly gas and oil (Chart 3). Moreover, in some countries certain industries—such as chemicals and minerals, metals, and manufacturing equipment—rely heavily on inputs from Russia. These industries stand to face a disproportionate impact if there are trade disruptions or price increases on energy imports from Russia.

Chart 3

Energy supply

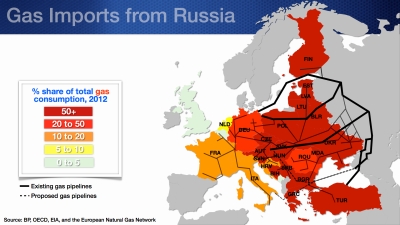

Europe relies on Russian gas, importing over one third of its natural gas from Russia through several major pipelines (the dotted line on the map is the planned South Stream gas pipeline). Russian gas accounts for over 50 percent of total gas consumption in virtually all countries in Eastern Europe and several advanced economies in Europe as well (Chart 4). However, as a share of total energy—rather than gas—consumption, Russian gas is somewhat less critical but still very important for several countries and especially so for Belarus and Moldova (Chart 5).

In the event of a price increase or disruption in gas supplies from Russia, countries’ ability to access alternative suppliers or energy sources will vary. For some countries, particularly those whose energy infrastructure is less nimble and whose gas inventories are relatively low, the transition could take longer and be more consequential. For example, the pipeline via Ukraine has the largest capacity and transports almost half of Europe’s gas imports from Russia, and so any disruption in the flow through that particular pipeline would have potentially serious effects on countries whose energy infrastructure relies heavily on it. Many European countries also depend heavily on oil imports from Russia, but those are easier to substitute from other suppliers than gas imports.

Chart 4

Chart 5

Also at iMFdirect:

Links and Levers: How the Caucasus and Central Asia Are Tied to Russia